Unified Payments Interface (UPI) has revolutionized the way we transfer money, offering speed and convenience. If you’re a Bank of India (BOI) customer and wish to use UPI for money transfers, this guide will walk you through the steps.

In today’s digital age, transferring money has become incredibly simple, thanks to the integration of UPI into mobile banking platforms. Bank of India (BOI) provides a seamless and secure UPI experience through its Omni Neo mobile app, making it easy for customers to manage transactions anytime, anywhere. Whether you’re sending money to family, friends, or vendors, BOI’s UPI feature is designed to meet your needs efficiently.

This article provides a comprehensive guide on how to use BOI’s mobile banking app to perform UPI transactions. From sending money using a UPI ID to transferring funds via account number and IFSC code, you’ll find step-by-step instructions to help you get started quickly and securely

Table of Contents

Steps for UPI Money Transfer Using BOI Mobile Banking

Make sure you are registered for BOI mobile banking and have activated UPI by linking your BOI bank account to mobile banking. You can select the UPI Transfer option, link your BOI bank account, and create a UPI PIN. Once you are done, you can start UPI money transfers on mobile banking. Let’s dive into the process and see how to transfer money through UPI on Bank of India’s omni neo bank mobile banking:-

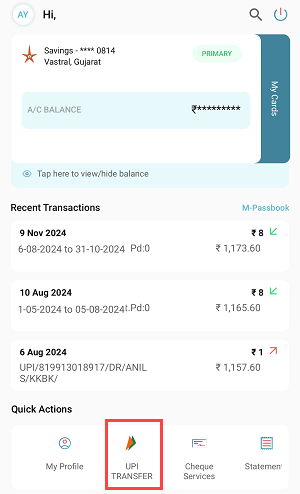

Step 1: Login to BOI Mobile Banking (Omni Neo Bank)

- Open the BOI Omni Neo mobile banking app.

- Enter your credentials to log in.

- On the home screen, tap on the UPI Transfer option (as shown in the screenshot below).

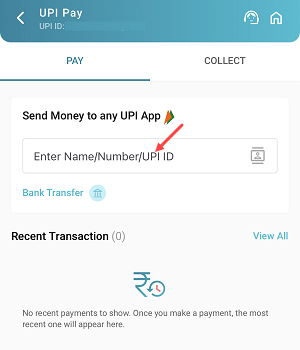

Step 2: Enter Beneficiary UPI ID or Mobile Number

- On the next screen, enter the beneficiary’s UPI ID or mobile number.

- If the mobile number doesn’t work, use the UPI ID for better reliability.

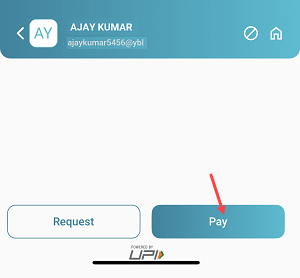

Step 3: Verify and Proceed

- After entering the UPI ID or mobile number, the system will verify the details.

- Once verified, tap on the Pay button to proceed.

Step 4: Enter Transfer Amount

- On the next screen, input the amount you wish to transfer.

- Note: The maximum transfer limit is ₹1,00,000 per day.

- Tap on the Pay Now button to continue.

Step 5: Authenticate with UPI PIN

- Enter your UPI PIN to authenticate the transaction.

- Once authenticated, the transfer will be initiated.

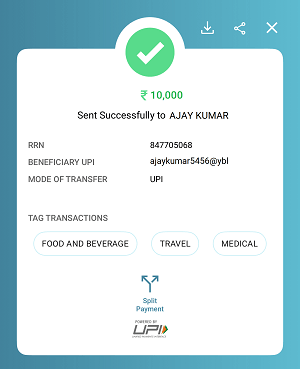

Step 6: Transaction Successful

- The money will be credited to the receiver’s bank account instantly.

- You will receive a confirmation message for the transaction.

Transfer Money Using Bank Account Number and IFSC Code

If you don’t have the recipient’s UPI ID, you can still transfer money using their bank account number and IFSC code. Follow these steps:

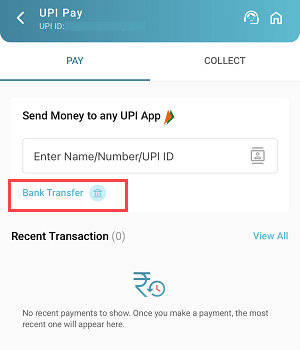

Step 1: Select Bank Transfer Option

- On the home screen of the app, tap on the UPI Transfer option.

- Select the Bank Transfer option (refer to the screenshot below).

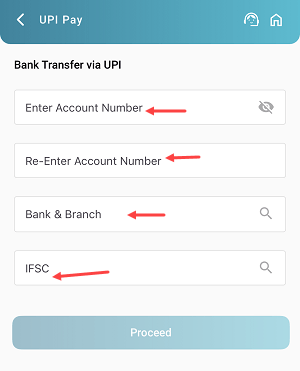

Step 2: Enter Beneficiary Details

- On the next screen, enter the following:

- Beneficiary’s bank account number.

- Select the bank name.

- Enter the IFSC code.

- Tap on Proceed to continue.

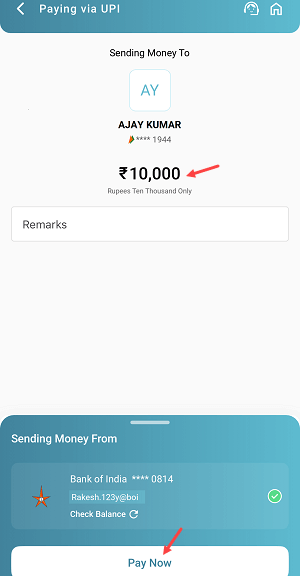

Step 3: Enter Transfer Amount

- Input the amount you wish to transfer.

- Tap on the Pay Now button.

Step 4: Authenticate with UPI PIN

- Enter your UPI PIN to confirm the transaction.

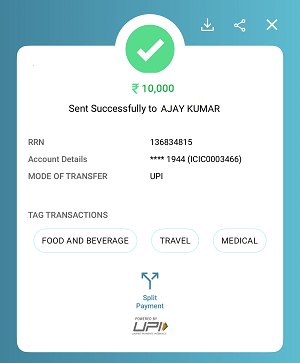

Step 5: Transaction Successful

- The money will be credited to the beneficiary’s account instantly.

- You will receive a notification for the successful transfer.

Conclusion

Using the Bank of India mobile banking app, transferring money via UPI is quick and easy. Whether you use a UPI ID or the recipient’s bank account details and IFSC code, the process ensures instant and secure transfers. Follow the steps outlined above to complete your transactions seamlessly.