The Public Provident Fund (PPF) is a trusted long-term savings scheme in India, offering tax benefits and attractive interest rates. If you hold a PPF account with ICICI Bank and need to access funds for emergencies or other purposes, you may be eligible for a partial withdrawal. ICICI Bank’s digital banking services make this process convenient and efficient. In this article, we’ll guide you through the exact steps to partially withdraw money from your PPF account online with ICICI Bank, ensuring you understand the eligibility, process, and requirements.

Table of Contents

What is a Partial PPF Withdrawal?

A partial withdrawal from a PPF account allows you to access a portion of your savings before the account matures. According to PPF rules, partial withdrawals are permitted after the completion of 6 years from the end of the financial year in which the account was opened. You can withdraw up to 50% of the balance available at the end of the 4th year preceding the withdrawal year or the end of the preceding year, whichever is lower. Only one partial withdrawal is allowed per financial year.

For example, if you opened your PPF account in April 2018, you can start withdrawing from April 2025 (the 7th financial year). The amount you can withdraw depends on the balance as of March 31, 2021 (end of the 4th year) or March 31, 2024 (end of the preceding year).

Eligibility for Partial PPF Withdrawal

Before proceeding with the withdrawal, ensure you meet the following criteria:

- The PPF account must have completed 6 years from the end of the financial year of account opening.

- You are allowed to withdraw 50% of the balance available at the end of the 4th year or the preceding year, whichever is lower.

- Only one withdrawal per financial year is permitted.

- The account must be in good standing, with no defaults on minimum annual deposits (minimum ₹500 per year).

Steps to Partially Withdraw Money from Your PPF Account Online with ICICI Bank

Here are the detailed steps to partially withdraw money from your PPF account using ICICI Bank’s online banking platform:

Step 1: Log in to Your Net Banking Account

Visit the ICICI Bank website and log in to your Internet Banking account using your user ID and password. Ensure you have access to your registered mobile number for OTP verification.

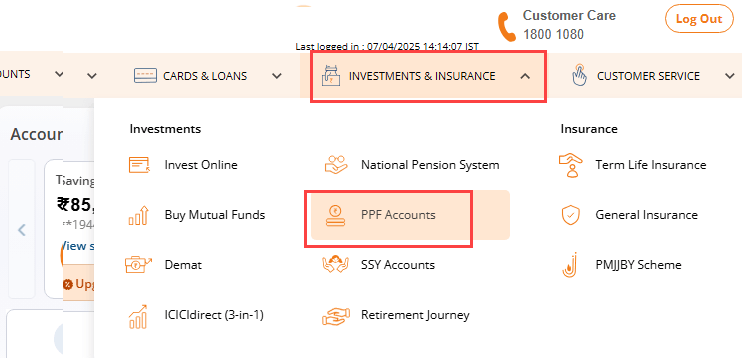

Step 2: Navigate to the Investment and Insurance Section

Once logged in, go to the Investment and Insurance section in the main menu. Here, you’ll find the PPF Accounts option. Click on it to proceed.

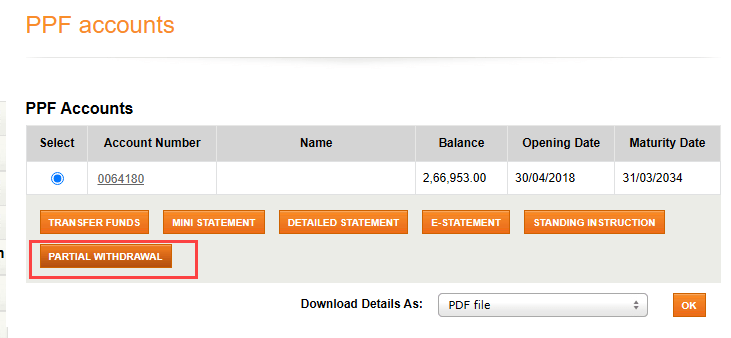

Step 3: Select the Partial Withdrawal Option

In the PPF Accounts section, locate and click on the Partial Withdrawal option to initiate the withdrawal process.

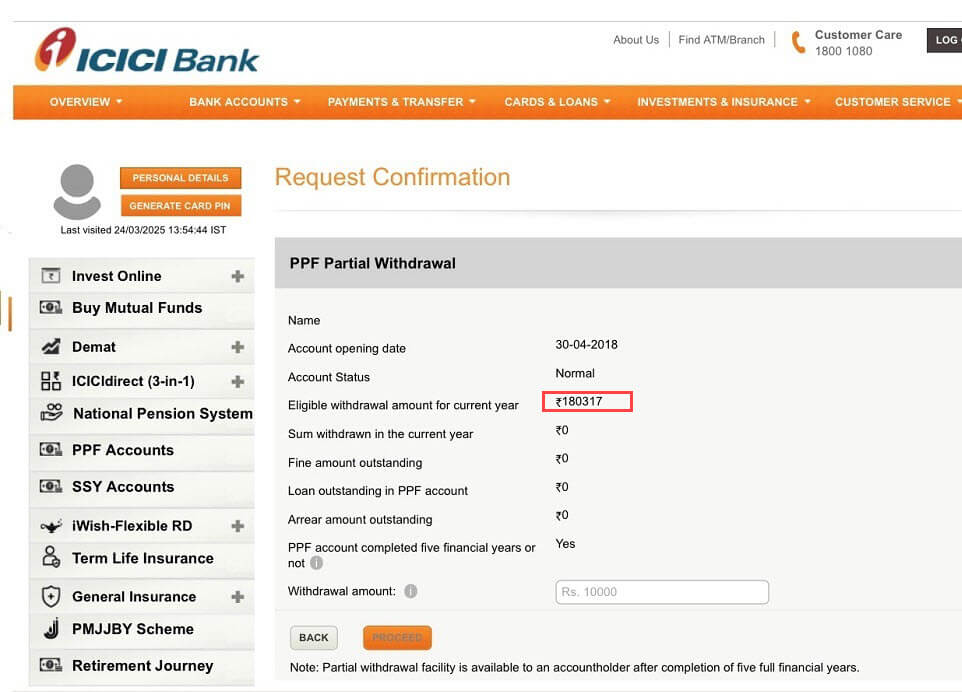

Step 4: Check the Eligible Withdrawal Amount

The next screen will display the eligible withdrawable amount for the current financial year. This amount is calculated based on PPF rules (50% of the balance at the end of the 4th year or the preceding year, whichever is lower). You can withdraw the full eligible amount shown.

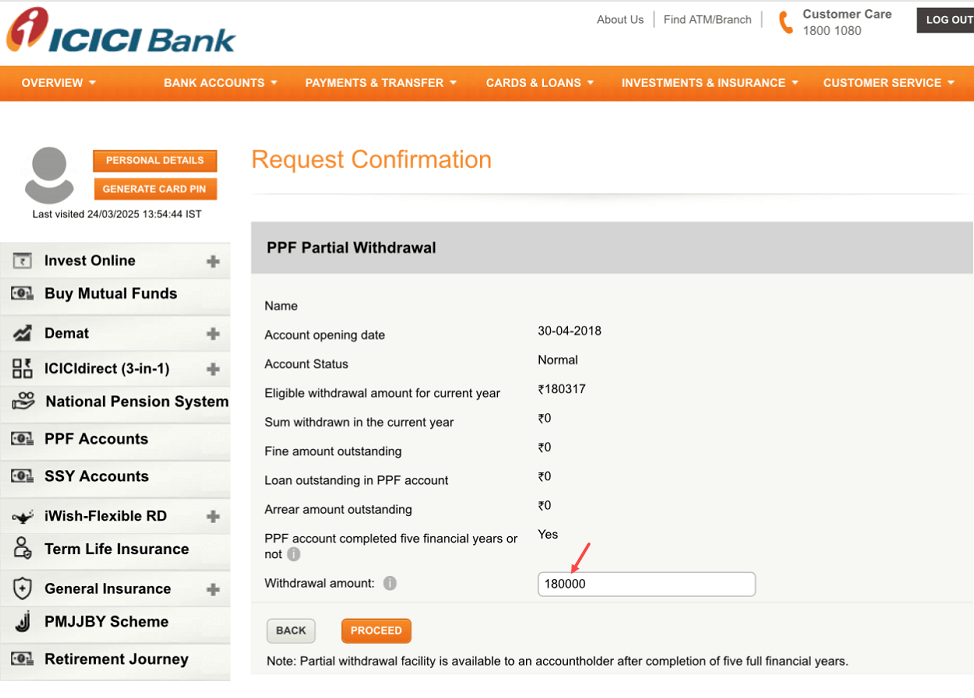

Step 5: Enter the Withdrawal Amount

Enter the eligible withdrawable amount as displayed on the screen and click Proceed to continue with the request.

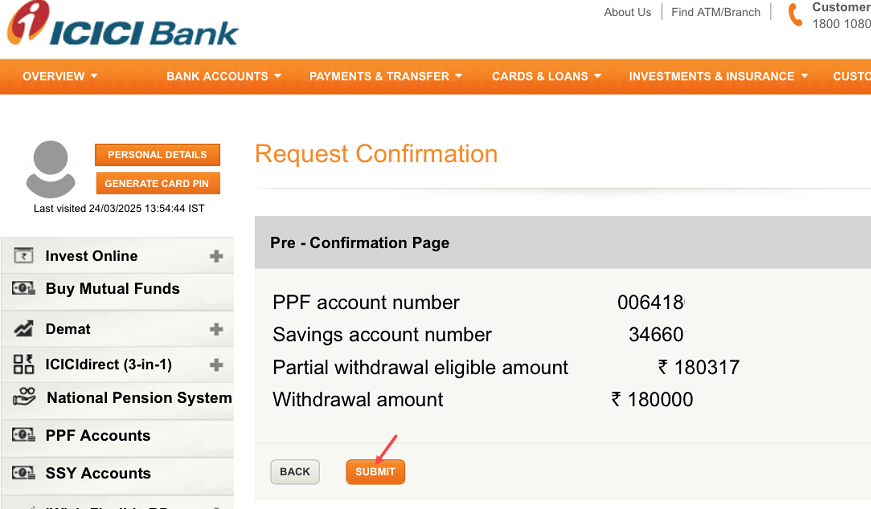

Step 6: Confirm Your Withdrawal Request

On the next screen, review the details of your withdrawal request. Click Submit to confirm and proceed with the transaction.

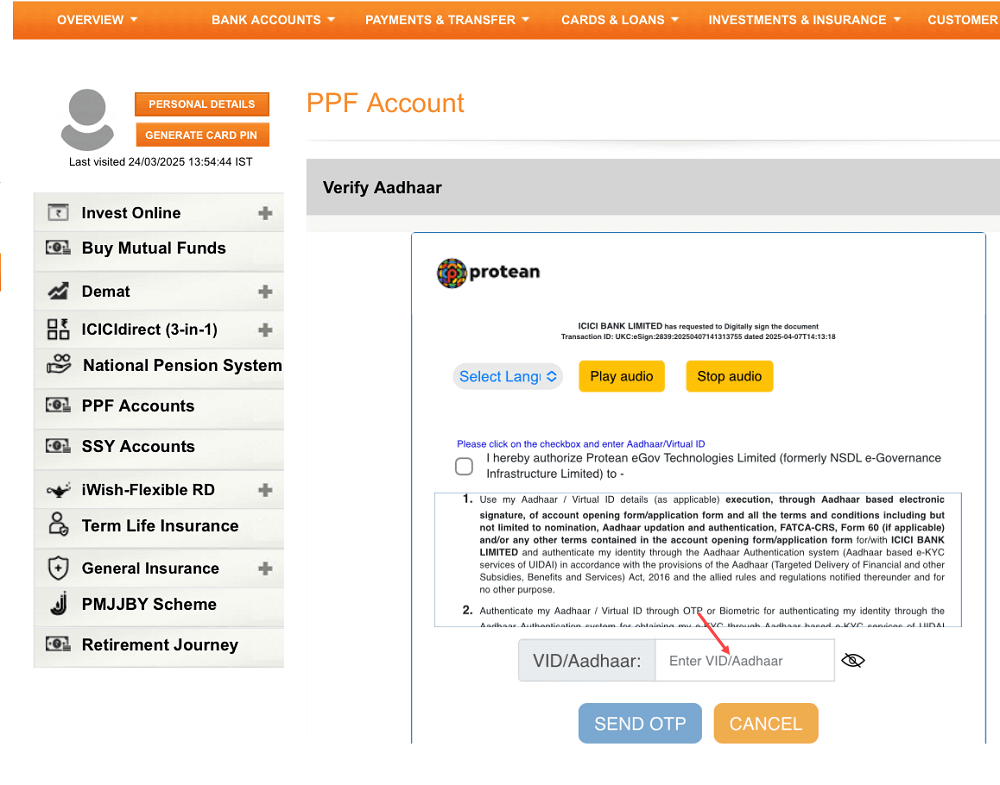

Step 7: Authenticate Using Aadhaar Card

For security, you’ll need to authenticate your identity. Enter your Aadhaar card number in the provided field and click Submit.

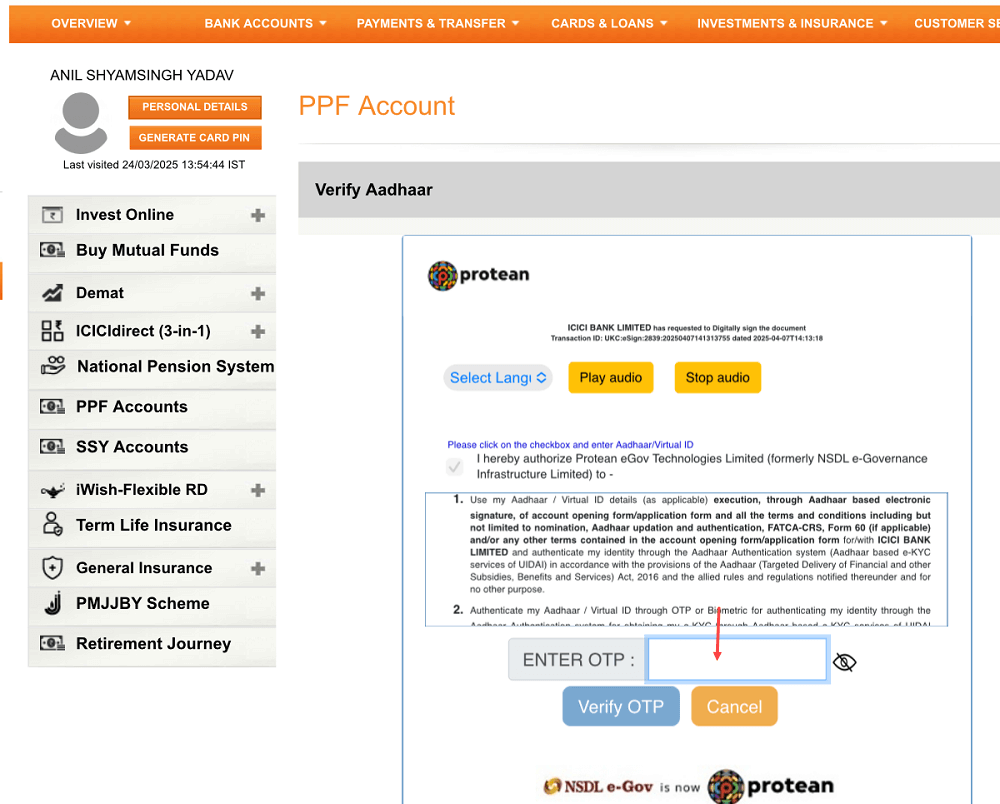

Step 8: Verify with OTP

An OTP (One-Time Password) will be sent to the mobile number linked to your Aadhaar card. Enter the OTP in the designated field to verify your identity.

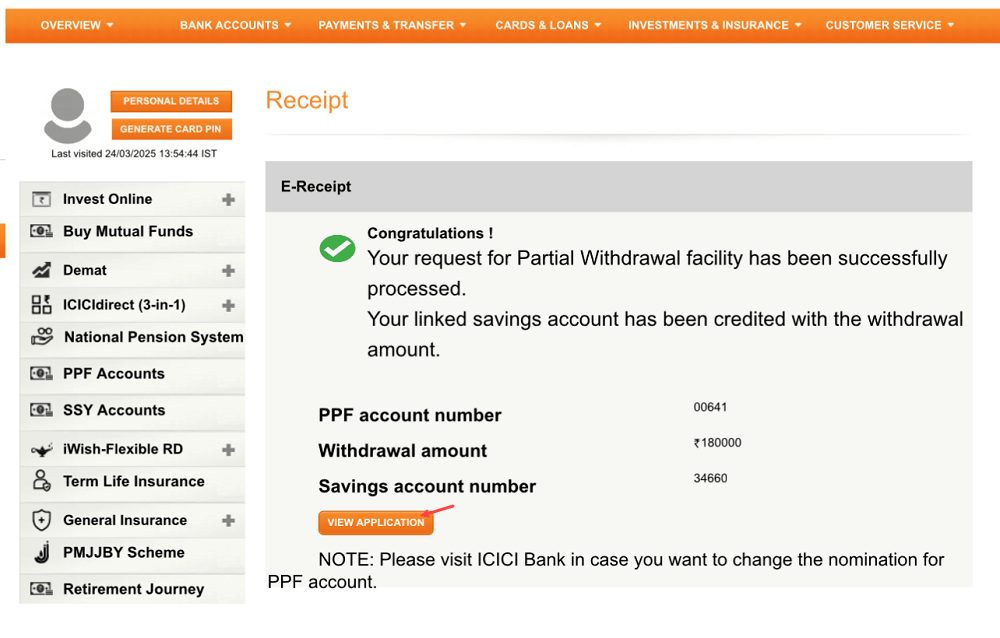

Step 9: Withdrawal Successful

Congratulations! Your partial withdrawal request has been successfully processed. You’ll see a confirmation message on the screen.

Step 10: Funds Credited Instantly

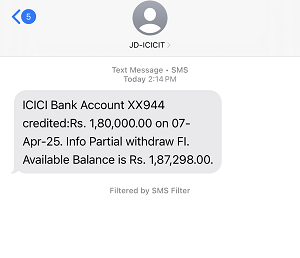

The withdrawn amount will be instantly credited to your linked ICICI Bank savings account. You’ll also receive a confirmation SMS from ICICI Bank with the transaction details.

Key Points to Remember

- Tax Benefits: Partial withdrawals from a PPF account are tax-free under Section 80C of the Income Tax Act, as PPF enjoys Exempt-Exempt-Exempt (EEE) status.

- Withdrawal Limits: You can withdraw only 50% of the eligible balance, and only once per financial year.

- Online Convenience: ICICI Bank’s online banking platform simplifies the withdrawal process, with instant fund transfers and Aadhaar-based authentication for security.

- Loan Option: If you’re in the 3rd to 6th year of your PPF account, you can also consider a loan against PPF instead of a withdrawal, which allows you to borrow up to 25% of the balance without reducing your savings.

Why Choose ICICI Bank for Your PPF Account?

ICICI Bank makes PPF account management seamless with its digital banking platforms. You can:

- Open a PPF account online instantly if you’re an existing customer.

- Set standing instructions for regular deposits (minimum ₹500, maximum ₹1.5 lakh per year).

- View PPF account statements and transaction history via Internet Banking or the iMobile Pay App.

- Transfer funds to your PPF account digitally using NEFT, ECS, or standing instructions.

The current PPF interest rate is 7.1% per annum (as of April 2025), compounded annually and paid on March 31st, making it a secure and rewarding investment option.

Conclusion

Partially withdrawing money from your PPF account with ICICI Bank is a hassle-free process thanks to its user-friendly online banking platform. By following the steps above—logging in, navigating to the PPF section, entering the eligible amount, and authenticating with Aadhaar—you can access your funds instantly and securely. Always ensure you meet the eligibility criteria and review the withdrawal amount to maintain your long-term savings goals.