Now you can get your pan card online instantly using your Aadhaar card. Income Tax Department has launched an Instant e-PAN card facility for resident individuals.

Instant e-PAN is a digitally signed Pan card in electronic format by the Income-tax department using Aadhaar e-KYC.

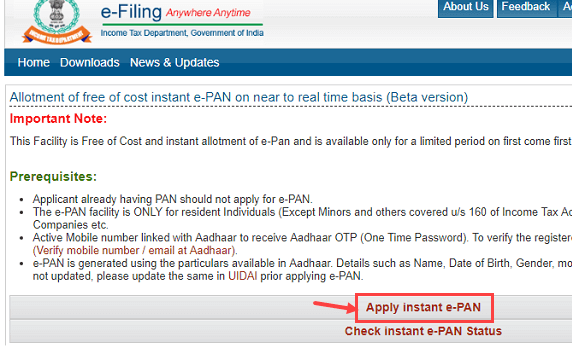

This facility is free of cost and instant allotment of e-PAN and is available only for a limited period on a first come first serve basis for valid Aadhaar cardholders.

How to apply for an e-PAN Card online

Please note, if you already have a pan card then don’t apply for the e-PAN card. Second, an Aadhaar registered mobile number is required to receive OTP during the application process.

The process is completely paperless and you don’t need to submit any physical documents.

See step by step process:-

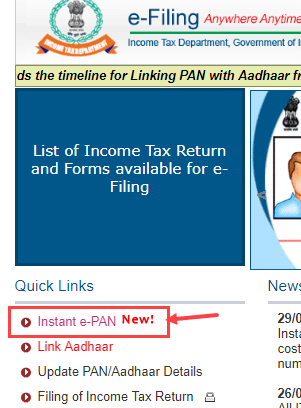

1# Visit the income tax official website: https://www.incometaxindiaefiling.gov.in

2# You can see the Instant e-PAN option, click and open it.

3# Now click on Apply Instant e-PAN option.

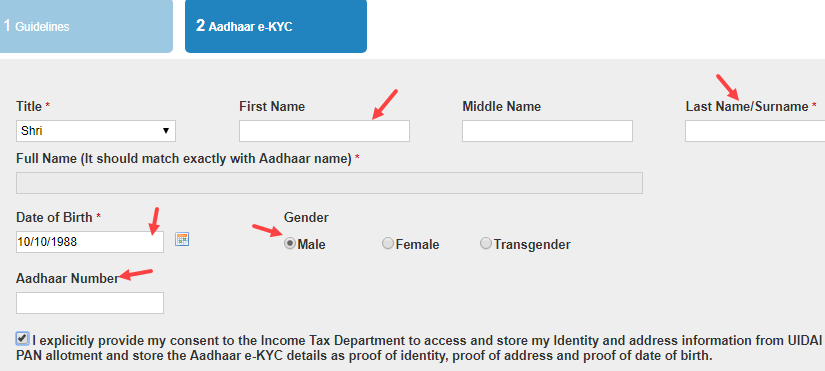

4# Now enter your name, Date of birth, Select Gender, and enter a 12-digit Aadhaar number.

5: Next page, you need to enter OTP sent on your Aadhaar card registered mobile number. Enter OTP and verify your Aadhaar number.

6: Next page you need to fill Pan card application. Also, you need to upload your signature scanned image in JPEG format. The image size should be max. 10KB only and the dimension should be 2×4.5 cm.

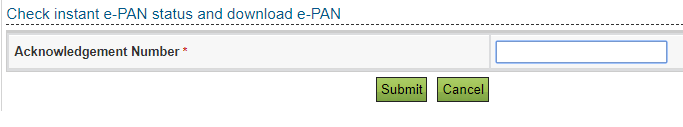

7: After successful submission of the application, you will get a 15-digit Acknowledgement number to your email address and mobile number. You can check the status of your application with this acknowledgment number also you can download an e-PAN card.

8# When your PAN card is ready, you will receive an alert on your mobile number or email address.

- To download your e-PAN card just visit the income tax website and click on Instant e-PAN card. Next, click on Check Instant e-PAN status. Now enter the acknowledgment number and submit.

So this is how you can apply and download for e-PAN card online.