Payzapp KYC is now mandatory for all users, so if you are using Payzapp wallet and have not completed full KYC then you can not use Payzapp wallet features like fund transfer to the bank account, adding money, and receiving offers.

Currently, Payzapp full KYC is available only for HDFC Bank account holders. So if you are an HDFC bank customer and using a Payzapp wallet then you can also complete your KYC online in just 1 minute.

HDFC Bank customers just need to link their bank account with the Payzapp wallet to complete KYC. Currently, this feature is not available for non-HDFC bank customers.

Ok so here we will guide you, how to complete Payzapp full KYC and activate your wallet again.

PayZapp Full KYC online – How To Complete

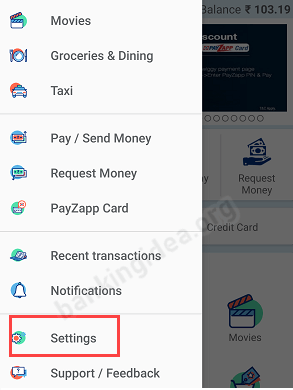

First, open the Payzapp wallet and go to Settings.

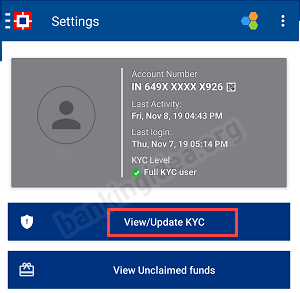

Here you can find view/update KYC option, just open it.

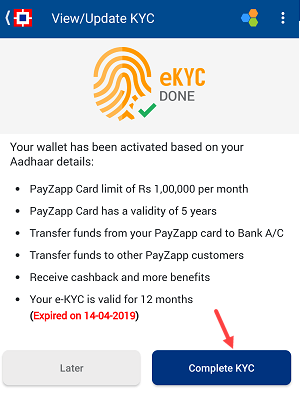

Next screen tap on the Complete KYC option.

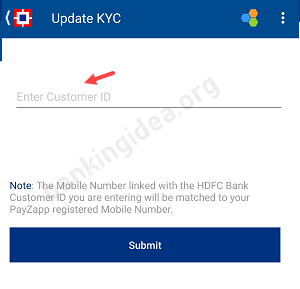

Now you will be asked “are you HDFC bank customer, tap on yes.

Finally enter your HDFC bank account customer ID which you can find on your passbook, e-statement, or through mobile banking/net baking.

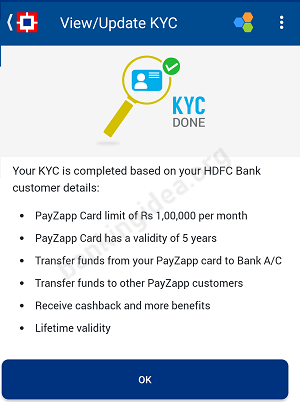

After enring your customer ID, your KYC will be completed.

After completing your Payzapp waller full KYC, now you can use your Payzapp wallet without any limits.

- Your wallet limit will be increased up to 1,00,000 per month, so you can add money 1 lac per month.

- You can transfer money from your wallet to any bank account.

- Your Payzapp card validity is now for 5 years.

- Payzapp wallet validity is now lifetime and you don’t need to complete KYC again.

- Cashback offers are now available for you

- You can also transfer money to other payzapp users

So this is how HDFC Bank customers can complete full KYC for the Payzapp wallet and get full benefits of the wallet without any limitation. If you are a non-HDFC bank customer and unable to complete your KYC then contact Payzapp customer care.